Brooklynites dive into 2026 at frigid Coney Island Polar Bear Plunge

Kirstyn Brendlen & Erica Price

Through the lens: Brooklyn Paper’s most striking, surprising and unforgettable photos of 2025

Compiled by Gabriele Holtermann

NYC landmarks, including miniature Brooklyn Bridge, highlight Holiday Train Show at NYBG

NYC landmarks, including miniature Brooklyn Bridge, highlight Holiday Train Show at NYBG Isla & Co. brings Aussie brunch, dinner and $3 coffee to Williamsburg starting Jan. 1

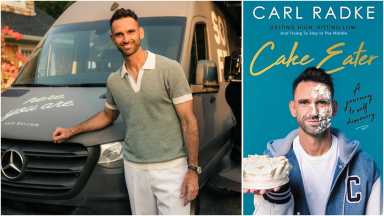

Isla & Co. brings Aussie brunch, dinner and $3 coffee to Williamsburg starting Jan. 1 ‘Cake Eater’: Carl Radke, owner of Greenpoint’s Soft Bar and ‘Summer House’ star, gears up for memoir release and nationwide tour

‘Cake Eater’: Carl Radke, owner of Greenpoint’s Soft Bar and ‘Summer House’ star, gears up for memoir release and nationwide tour Brooklyn Children’s Museum celebrates Kwanzaa with music, art and dance

Brooklyn Children’s Museum celebrates Kwanzaa with music, art and dance Actor brings ‘Gravesend’ cast to Avenue U for buzz-worthy holiday celebration

Actor brings ‘Gravesend’ cast to Avenue U for buzz-worthy holiday celebration