Brooklyn Dodgers great Sandy Koufax isn’t the only native son to strike out with alleged $50 billion Ponzi schemer Bernard Madoff.

According to court filings released last week, the borough’s victims run the gamut from the well-known, like Fred Wilpon, the Brooklyn-born owner of the New York Mets, to the comparatively obscure, like a Flatbush investor who enjoyed returns of close to 20 percent annually – until the alleged house of cards collapsed in December.

Madoff clients contacted by this paper were reticent to speak, but those who agreed said they never had an inkling of impropriety.

“Bernie Madoff [Investment Securities] was the most trustworthy of all the investment firms. I mean, look at the list of people who went with him,” the Flatbush investor said. “So my initial reaction was shock.”

The investor, who wished to remain anonymous, said that back in 1992 when he first invested with Madoff, he was exceedingly cautious.

“After I made my first investment, I let time go by, and I requested a check. Within a week, I got a check. Then, I waited another few months, I asked for another check. No problem,” the person said.

The investor said he enjoyed annual returns just under 20 percent, with 10 percent being the lowest. “Things seemed very good, from 1992 – until Dec. 11, 2008,” the person said. On Dec. 11, Madoff allegedly admitted that his investment firm was essentially a Ponzi scheme. He now faces criminal and civil court cases, while many of his victims face uncertain financial futures.

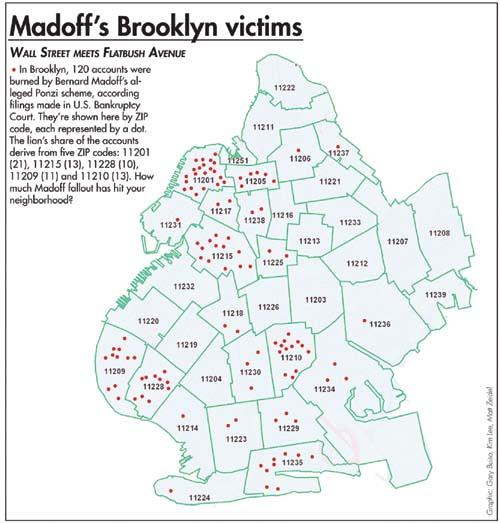

Institutions, trusts, trustees, agents and individuals are among the 13,567 customer accounts on the list. No dollar amounts were included in the 162-page list made as part of a filing in U.S. Bankruptcy Court. More than 5,000 accounts were in New York State, with over 100 having Brooklyn addresses.

The Brooklyn College Foundation, an entity that raises money for the college, received a donation that was invested with Madoff in 1991, at the discretion of the donor. The gift, which endows one scholarship, today totals $336,000.

Andrew Sillen, the executive director of the Foundation, said its exposure is minimal, amounting to less than one percent of its assets.

“None of the more than $45 million under the control of the Foundation’s investment committee were placed with Madoff Securities,” Sillen said in a statement.

Last August, the college’s investment committee decided not to invest more money with Madoff’s firm. “The committee was skeptical due to Madoff’s unwillingness to provide transparency or discuss his philosophy, process, or strategy, which provided unrealistically high positive returns every year,” Sillen said.

Also on the list is the Redemptorists of the Baltimore Province, a Roman Catholic community of priests and brothers, appearing on the client list as the Redemptorist Fathers of New York, located at 7509 Shore Road in Bay Ridge. The group refused to say how much it invested, but said that the returns were used to “fund Catholic school scholarships for inner city children, to train future priests and brothers, to care for our elderly members, and to fund other pastoral ministries.”

“It is with sadness in our hearts that the Redemptorists must acknowledge that some of the good works and ministries of the Province may now be reduced, suspended or cancelled due to the loss of funds,” the group said in a statement. “The Redemptorists’ prayers are with all who were adversely impacted by this unfortunate turn of events, They include Mr. Madoff and his family in their prayers as well.”

Other notable names include the Brooklyn Cyclones, who made the list through Brooklyn Baseball Company and Coney Island Baseball, the business entities that own the Mets farm team. The late Howard Squadron, the prominent attorney and father of freshman state Senator Daniel Squadron, is also on the list. At press time, Squadron did not return a call for comment.

A Fort Greene investor said news of the scandal was a complete shock.

“We were in it for 10 years. We got regular statements that were incredibly detailed. We declared every cent on our taxes,” said the investor, who requested anonymity. “Our accountant reviewed everything every year and found nothing wrong.”

An initial investment of $300,000 generated returns of roughly 10 percent a year – through good or bad times, the person said. “Last year everybody lost money, but Madoff made 3 percent. “We were like, ‘How did he do that?’”

Now, the person continued, the answer is becoming clear.

“Very quickly, we made up our minds and said: ‘It’s gone. What can you do, except get on with your life?’” the Fort Greene investor said. The person’s in-laws, meanwhile, have been “totally wiped out” by the disgraced financier. “Our concern is for people in our family who had a lot more invested than we did. “These are people in the 80s.”

The news was even more shocking, because Madoff, the person continued, had an incredible reputation which made people feel safe. “He gave the impression of total security,” the person said.