The King’s College, a small Manhattan-based Christian school, is in deep financial trouble — and, as it struggles to raise funding to stay open past the end of this semester, it’s allegedly stopped paying rent for student apartments in a Downtown Brooklyn apartment building.

King’s students living at the Azure, a swanky high-rise near City Point, started receiving notices about missed rent payments addressed to The King’s College last month, as first reported by the student newspaper the Empire State Tribune.

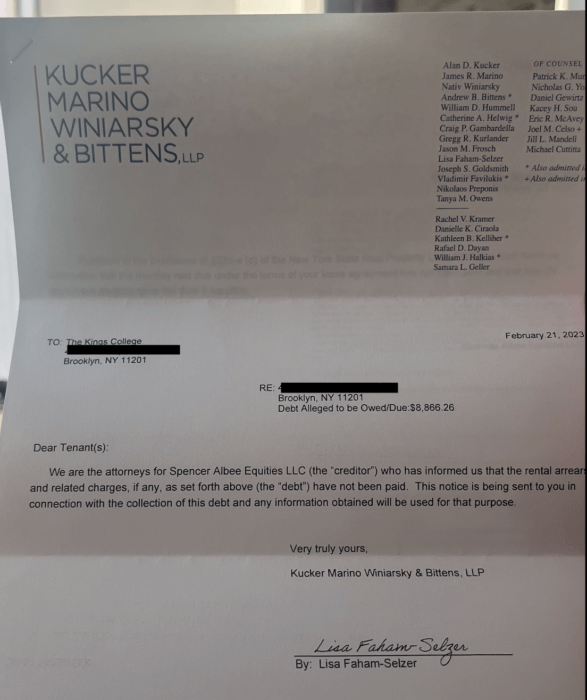

“We are the attorneys for Spencer Albee Equities LLC (the “creditor”) who has informed us that the rental arrears and related charges, if any, set forth above (the “debt”) have not been paid,” reads one such notice, dated Feb. 21. “This notice is being sent to you in connection with the collection of this debt and any information obtained will be used for that purpose.”

Eviction notices arrive in student mailboxes

Many students received more serious letters last month, warning that building management could pursue eviction if King’s doesn’t pony up two months of missing rent payments, totaling more than $9,000 per apartment.

School leaders have repeatedly assured students that their housing is not in jeopardy, citing New York’s strong tenant protection laws, and have reportedly told students the school is in conversation with the landlord to resolve the issue.

But building management said the school has been uncommunicative regarding the missed payments, despite repeated attempts to make contact.

“No one to speak to, absolutely dead end,” a representative of the building’s management team, who asked not to be named, told Brooklyn Paper. “We have tried to make every type of attempt by email and phone to them. The CEO, the president, every email we have, and we have gone ignored.”

In one instance, the school directed Azure management to contact their lawyer — who was similarly unhelpful. The representative said the Azure has offered to work out a payment plan, or to accept partial payments from the school, but those offers have been ignored.

When contacted by Brooklyn Paper, a King’s College spokesperson referred back to a recent update posted to the school’s website. She did not answer questions or provide a statement from the school.

King’s first signed a lease agreement for a number of two-bedroom apartments at the high-rise in 2018. The college currently rents about 30 units, according to the management rep. Per StreetEasy, two-bedroom apartments at the Azure rent for about $4,500 per month.

A few months after the college secured the lease at the Azure, it purchased a residential building on Greenwich Street in Manhattan for just over $19 million.The school is now trying to sell the Greenwich Street building, known as “DeVos Hall.”

“Our goal in the coming years is to have multiple residential acquisitions,” then-acting president Tim Gibson said in a statement at the time. “Owning our housing enhances the long-term financial stability and viability of the College, affords us the opportunity to make the building completely ‘King’s,’ and facilitates formation of strong bonds that are crucial in our close-knit community.”

Each two-bedroom apartment houses four students, two per bedroom. Every semester, each student pays the school about $7,200 in “room charges,” according to a bill provided to Brooklyn Paper, for a total of almost $29,000 per unit over a four-month period.

Early this year, King’s announced that it needed to raise more than $2 million to make it through the end of the semester.

“The King’s College is currently experiencing a $2.6 million dollar funding shortfall that is jeopardizing the future of the College,” the school wrote in a March 8 update. “King’s has been caught in a perfect storm of financial pressures this year, between a slow, post-Covid-19 recovery, an economic decline, and rising interest rates which have complicated the sale of our DeVos building.”

The school has “bridge funding” that will allow it to pay faculty and staff through the end of the semester, as well as hold a graduation ceremony, according to the update, but still needs money to “finish the semester well.”

The Tribune reported that that funding came in the form of a $2 million loan from Peter Chung, CEO of Canadian investment firm Primacorp Ventures. In 2021, the college announced a new partnership with Primacorp to “to grow the NYC program to optimize use of the current campus” and “build out online academic programs.”

The school still needs to raise money to fulfill the rest of its financial obligations, though, and told students it would be “prudent to have considered a Plan B for next fall” in case it cannot secure enough money to stay open past the end of the current semester.

Sophomore Kayleigh Burrell said she knew the school was facing some financial difficulties — it announced a number of “strategic changes” including cutting the number of full-time faculty and tuition increases last fall — she was shocked to discover how dire things had become when students started receiving eviction notices.

“The student body as a whole hasn’t felt the school has been very open and transparent with these financial troubles,” she said. “I feel like they tried to downplay it as much as they could until it got too much.”

The sophomore took a year away from school after her freshman year was interrupted by the beginning of the COVID-19 pandemic. Like thousands of other students, Burrell went home for spring break in March 2020 and did not return to campus for months. She worried King’s financial woes would result in a repeat this year.

“I am a little fearful of that,” Burrell said. “Now that we’ve got this $2 million loan for faculty, I feel a little better about it, because that extra fundraising money should be solely going to pay for our housing, you would hope.”

The college has been addressing ongoing difficulties in a series of community meetings with students. After one such meeting, a friend of Burrell’s emailed in a question — what had the school been doing with the money students were sending in for housing?

“The answer back was that all of our money goes into general funding, including our housing money and tuition money,” she said. “They basically pulled out of that pot until there was nothing left to pull out of.”

Before that donation was announced, Burrell said she felt “85% sure that we’d close after spring break.”

Now that it seems they’ll at least finish the semester, she’s had to try to turn her grades around — when it seemed the school might close any day, her academics slipped.

“A lot of us were having a hard time focusing in class, we’re getting rent notices, it’s hard to stay motivated if it seems like it will be for nothing in a couple days,” she said.

Financial troubles and PrimaCorp

According to tax documents, King’s College was operating in the red in the fiscal year ending in August 2020 — racking up $33 million in expenses and taking in only $27 million in revenue.

Things got worse the following year – according to a tax audit, the school ended the 2021 fiscal year nearly $4 million in debt, despite having received $4 million in contributions and more than $2 million in government grants.

According to the audit, when Kings entered its partnership with Primacorp in spring 2021, it agreed to pay a Primacorp subsidiary, TKC Operations Inc., 15% of tuition revenue, net institutional aid and refunds in exchange for its services — including marketing, recruitment, and fundraising — each year for the 30 years of the agreement.

As part of the agreement, Primacorp also has the ability to nominate four out of nine members to the King’s College Board of Trustees.

Primacorp’s first bill, of about $38,000, arrived in August that year, and was not immediately paid. King’s also incurred $470,000 in “personnel and other expenses on behalf of TKC Operations, and expected to be reimbursed.

The college also secured a “revolving line of credit” of up to $10 million from Burnaby Investments, a firm related to Primacorp. The line was secured by college property, and did not have any outstanding payments as of August 2021.

Finally, according to the audit, the “chairman of TKCO’s parent organization” – Chang – promised to donate up to $2.5 million to the college, with conditions. Chang agreed to match qualifying donations $1 to $3, up to more than $833,333 each year “subject to approval annually by the donor.” As of summer 2021, those conditions had not been met, and no donations had been made.

Another school involved with Primacorp, Quest University near Vancouver, is also in serious trouble. When Quest faced financial collapse in 2020, the firm purchased the college’s buildings and land for $43 million in an effort to save it, according to Business in Vancouver. As part of the deal, Primacorp would provide recruitment, marketing and fundraising services to Quest.

Last month, Quest announced it will close indefinitely in April. Shortly after the announcement was made, Primacorps put the school’s property for sale. School authorities said they were surprised to learn that parts of the school had been listed for sale since late 2022.

Students begin to look beyond The King’s College

In a March 8 email to supporters, the college said it had raised a total of $92,184 over the previous four days, thanks to $61,184 in donations and a $30,000 match provided by “generous community members.”

“While we are encouraged by the response of the King’s community, there is still more work to be done to ensure that King’s is able to continue on,” the email reads. “Students and parents can be assured that we are on track to a successful completion of the semester.”

Another community update meeting is scheduled for the week of March 20, after spring break, students said.

Mandie-Beth Chau, a freshman journalism student who has been covering the debacle for the Tribune, reported that the $2.6 million the school is trying to fundraise does not cover the back rent at the Azure.

“We have this $2 million loan, but that $2 million loan will only be paying for faculty and staff payroll through the end of the semester, and not cover housing at all,” Chau told Brooklyn Paper. “So this whole time they’ve been fundraising and saying they’ve needed $2.6 million, and they actually needed $4 million.”

Chau is considering her transfer options for next year, in case the school is unable to reopen. Her classmate Burrell has already been accepted at a new college, and said many of her professors are also announcing their plans to depart after the close of the semester.

“If the school is saved, then that would be great, because I do really love this school,” Chau said. “I love the curriculum, and the professors, and the other students, and just the general experience is really different, and I really love it.”

But, especially as she’s been reporting on the school’s financial issues, some “questionable” issues have arisen.

“King’s can’t function on its own, they need money from somewhere,” she said. “They need money from somewhere, but I don’t know that they’re always getting it from places that have King’s best intention in mind.”

Burrell felt similarly – the school’s message that everything would work out at the Azure because of New York’s eviction protections even as rent went unpaid felt like a conflict with its Christian values.

“It just doesn’t seem to match with the principles or values of our school to be sending out to screw over our landlords,” she said. “In a luxury building in Downtown Brooklyn, which is part of their appeal to get you to come here in the first place.”

The management representative at the Azure told Brooklyn Paper he “doesn’t believe in eviction,” and would rather not sit in housing court to resolve the issue — but that there are not a lot of options.

King’s has announced that it is working out transfer agreements with seven schools, to ease the transition for students who do decide to leave.

“I’m just not attached to the idea of staying here if it goes under,” Chau said. “Things are temporary.”