The city’s highly controversial “tax lien sale” expired on Monday, but the future is uncertain for a program long derided as predatory towards communities of color, particularly those who have built wealth through homeownership.

Legislation authorizing the sale, which dates back to the administration of then-Mayor Rudy Giuliani, sunsetted on Monday — meaning the sale will not happen again unless the City Council and Mayor explicitly authorize a new one.

City Council Speaker Adrienne Adams said on Monday that she would like to put the sale in the past and enact “new solutions” to replace it.

Mayor Eric Adams campaigned on ending the sale, and on Tuesday, a rep for the mayor said Hizzoner is committed to “explor[ing] alternatives” to the sale.

“Mayor Adams believes the City should explore alternatives to the current lien sale that ensure the city can continue collecting its debts while helping homeowners — particularly Black and Brown homeowners who have been disproportionately impacted by the pandemic — retain ownership,” a city hall spokesperson told Brooklyn Paper.

Longtime advocates for ending the sale, like the East New York Community Land Trust, are cautiously optimistic. Debra Ack, the group’s secretary, told Brooklyn Paper that she is glad to see the program sunsetting for now, but that at the end of the day, the city could still quietly reauthorize it if it’s looking for a quick buck.

“We still need to work on legislation so that it can not ever be reauthorized,” Ack said. “They could do anything. Just because today it’s sunset doesn’t mean in a month, three, four, six months down the line, they may go, ‘oh, okay, let’s bring back the tax lien sale.’ No, we don’t want that. We want it to die altogether.”

The sale was created to farm out the collection of unpaid property tax debt to the private sector. Every year, the city would hold the sale where delinquent homeowners’ debt was sold at a discount to a private trust, which could then hire private servicers to collect on the debt, often adding steep interest and fees that only make the debt even harder to pay back. The trust was also empowered to eventually foreclose on people’s homes. The most recent lien sale, which may prove to be the last, took place in December of last year, after a two-year COVID-induced delay.

The sale allowed the city to easily and quickly generate millions of dollars in revenue on debt that would otherwise take significant resources and manpower to collect. But year-after-year, the liens sold to the trust disproportionately belonged to homeowners in lower-income communities, and communities-of-color in particular, and many homeowners came to see it as an engine of displacement and harassment, and a destroyer of generational wealth particularly among Black homeowners.

For those debtors who don’t get foreclosed on, the pressure of being unable to pay the bills and constant harassment from bill collectors often leads people to sell their homes.

“The trust is only interested in making money off of someone’s misfortune, someone’s debt, then acquiring the home and flipping it,” Ack said. “The predators will come out, ring people’s doorbells, knock on their doors, call them, follow them I’ve been told, and try to pressure them to sell their homes.” Those who do sell their homes often do so “out of fear of being totally put out on the street.”

When distressed homeowners are backed into a corner and sell their homes, the owners are not the only ones displaced: oftentimes, so are any tenants who may be leasing units on the property, who may be forced out by a new owner intent on flipping the building or bringing in new clientele.

In the 2021 sale, the Brooklyn City Council district with the most liens sold was the 41st, which includes parts of Brownsville, Bedford-Stuyvesant, and Crown Heights, and is one of the Blackest districts in the city. 148 liens were sold in the 41st District during that sale. Other neighborhoods with high lien sales included District 46 (Canarsie, Flatlands, and Marine Park) with 114, District 37 (Bushwick and East New York) with 112, and District 36 (Bedford-Stuyvesant) with 102.

The fewest liens were sold in District 43, which includes Bay Ridge, Dyker Heights, Bensonhurst, and Bath Beach, with just 32 liens sold. District 43 is also one of the whitest in Brooklyn.

Ack and other advocates in the Abolish the Tax Lien Sale coalition have devised a new model for collecting on delinquent property tax debt which they say would prevent displacement and ensure the stewardship of permanently affordable housing. The framework is based on the community land trust model, wherein a nonprofit stewards a parcel of land under its ownership, but the homeowners living on that land retain ownership of their actual domicile. Decisions are made democratically by a board of owners and stewards, and the stated goal is to keep the land permanently affordable.

Under the CLT advocates’ model, homeowners with long-delinquent debt would have the option of having their debts forgiven by the city by transferring the deed to their land to the community land trust, under a system known as a “ground lease.” Their ultimate goal is to keep the homeowner in their home; the homeowner would still pay property taxes on their actual home, but the CLT would pay taxes on the land itself, which would prevent the homeowner from facing unpayable bills and allow rents to stay affordable for tenants.

If a homeowner doesn’t acquiesce to transferring their land to a CLT, the city, under the framework, could initiate a foreclosure. If the homeowner still doesn’t want to transfer, and the home is foreclosed upon, the land could then be transferred to the CLT anyway, which advocates say would still work to keep the owner in the home.

“Our model, which includes community land trusts, it basically creates different possibilities for property owners,” said Hannah Anousheh, a coordinator with ENY CLT. “It’s ensuring that people can always stay in their home.”

There were 17 CLTs operating in the city as of June 2021, including two in Brooklyn: East New York and Brownsville, according to the NYC Community Land Initiative. CLTs are codified in city law as entities which the city can enter into agreements with, and a number of them already exist, such as in East Harlem and the East Village in Manhattan. Other groups like ENY CLT say they have identified dozens of underused parcels that could be better utilized under the stewardship of a CLT.

Whether the ambitious model could actually take root is anyone’s guess. Ack is part of a task force aimed at creating a fairer system for collecting delinquent debt, but she says the Department of Finance has so far not been very amenable to the proposal, rejecting it outright instead of going through on a step-by-step basis what needs work.

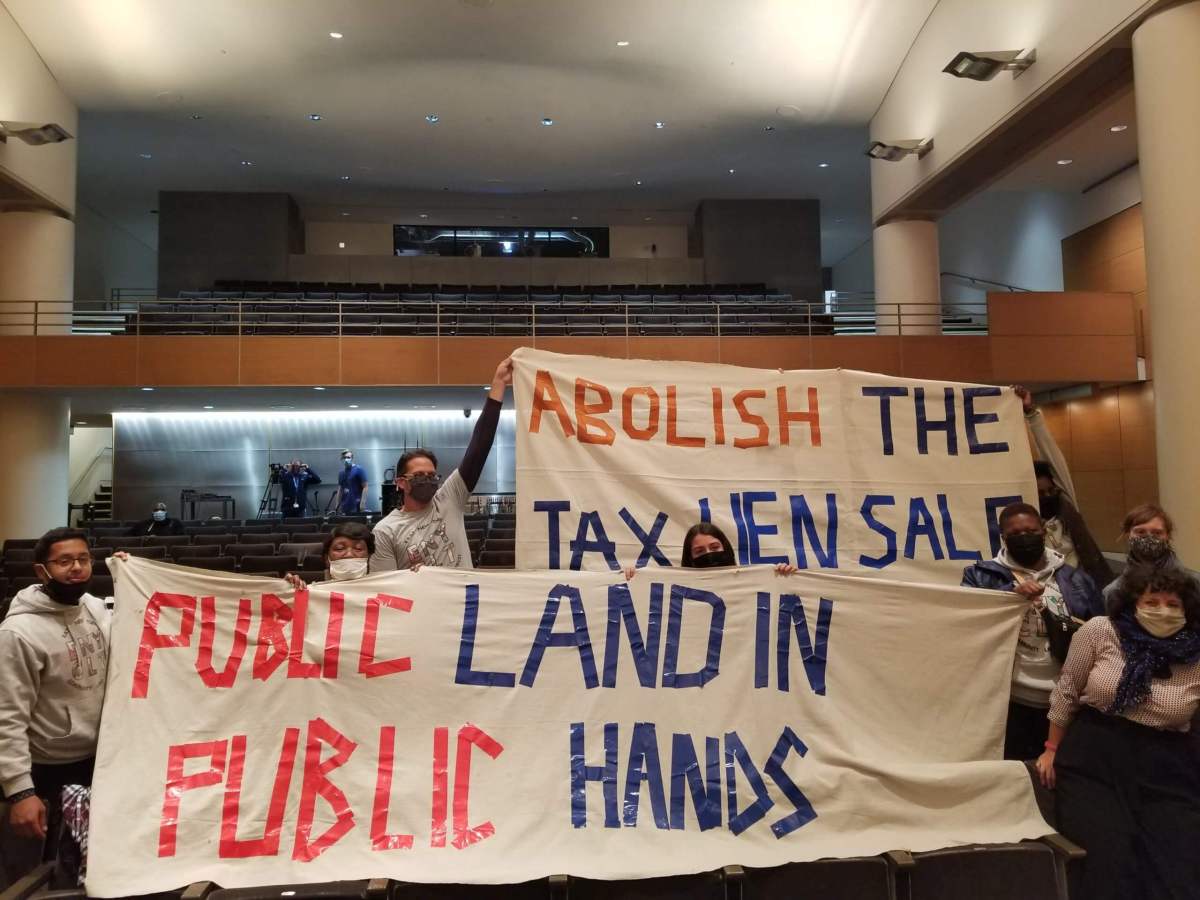

But the model has gained the support of a number of electeds, who rallied at City Hall on Monday with advocates as the tax lien sale expired.

“Historically, the tax lien sale has disproportionately stripped generational wealth away from working class homeowners of color by selling off their debt,” said City Comptroller Brad Lander in a statement. “This debt sale practice hit struggling families the hardest during the pandemic. Now that the practice of tax lien sales is ending, we must use this moment to collectively create new models of community ownership, while addressing outstanding debts and maintaining funding for the delivery of basic public utilities.”